Document Types functionality has been added to simplify the process of transaction reconciliation, so you don’t have to remember which transactions should generate which entries in the system and to avoid errors caused by incorrect data entry.

Transactions Tab

This tab allows you to configure all the entries that are created when reconciling transactions.

All transactions are grouped into income and expenses. For instance, if it is an incoming transaction, you will be offered a set of document types from the “Income” group, and if it’s an outgoing transaction, the type will come from the Expenses group.

Fields — options for selecting which fields need to be filled out during the transaction reconciliation process.

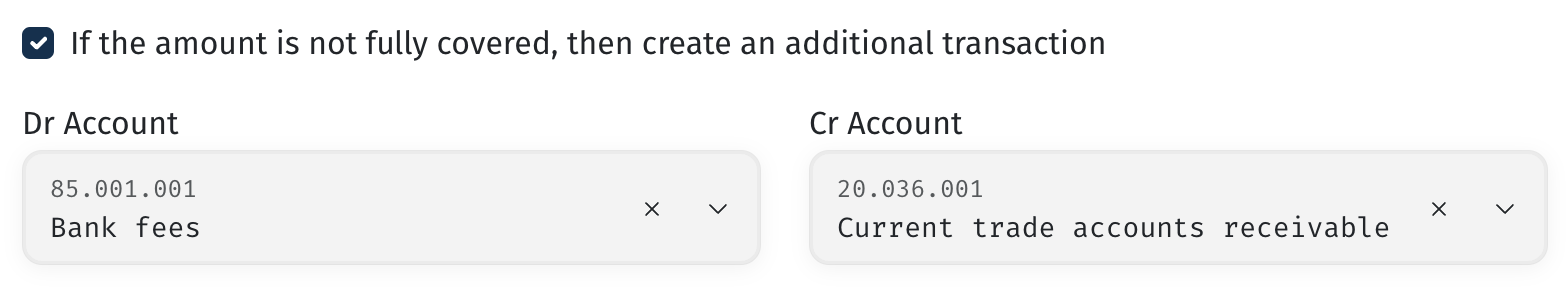

If the amount is not fully covered, then create an additional transaction — a checkbox that allows setting up an additional entry that will be generated if the payment amount is incomplete. For instance, it may include a bank fee. In this case, if this option is selected, the system will automatically assign the remaining amount to the entry you specify below, such as assigning it to a bank fee.

Examples of setting up certain document types

Example 1: Payment of an Invoice from a Client

Payment for an invoice generates income, and on the credit side, it is recorded as the closure of receivables on account 20.036.001.

In the Income/Expense category field, we specify that this is a payment from a client so that this transaction is reflected in the Cashflow. The Counterparty and Project fields are marked as required because we want to close the debt of a specific client for a specific project, and these must be selected during payment reconciliation.

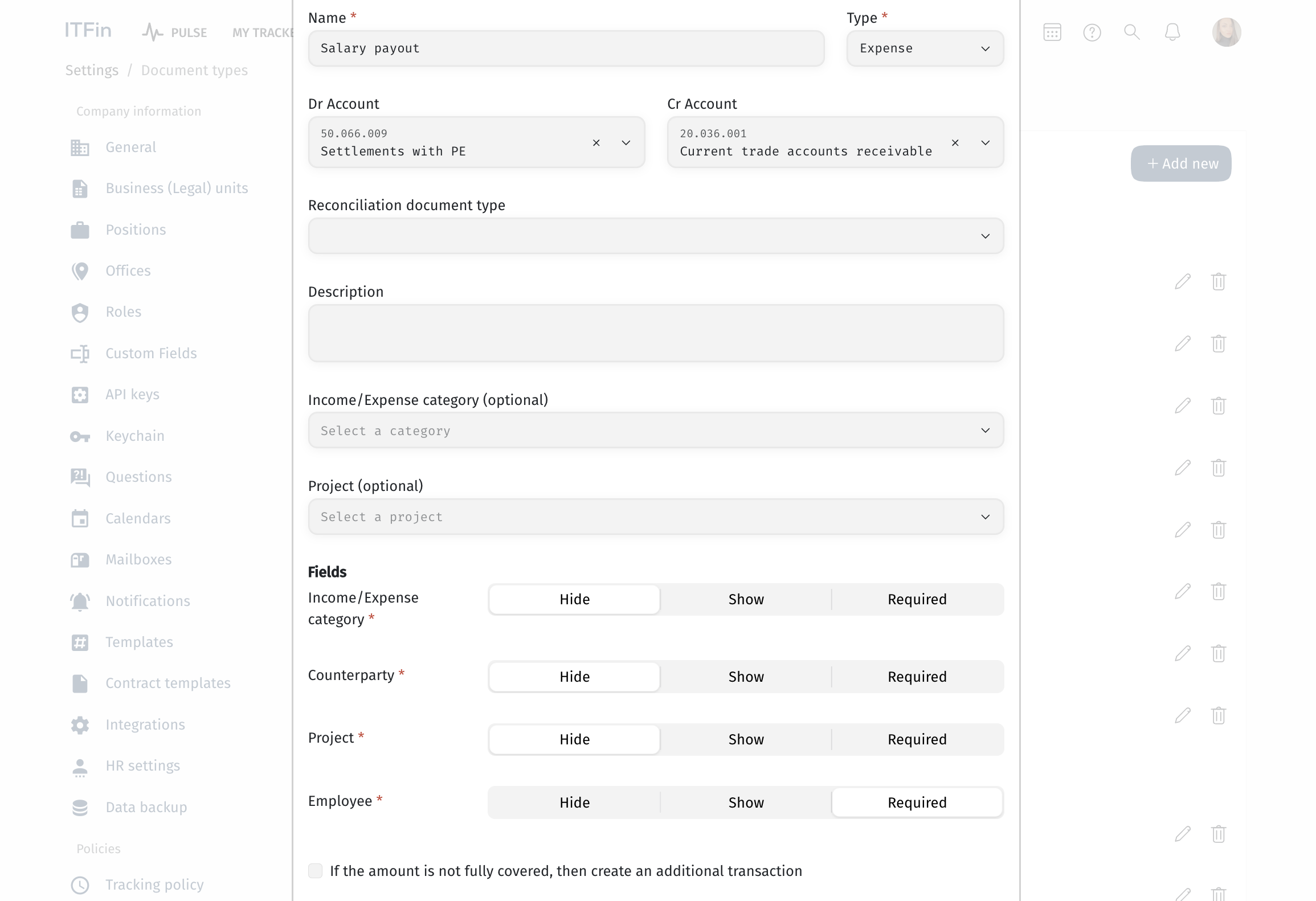

Example 2: Salary payout to employees

Salary payment is the settlement of debt to employees, so the Type is Expense. On the debit side, it is the closure of account 50.006.009. In the Income/Expense category field, you should specify that this operation is an expense in the form of salary payment. The Employee field is required because it’s necessary to record which employee’s debt has been settled.

FAQ

Question: Is there an example of basic settings for Document types?

Answer: Yes, we can provide an example of basic settings, and the company can further adjust them as needed.

Question: If the company has already used the ITFin financial functionality and performed reconciliation manually, how should they transition to using Document types?

Answer: It is sufficient to configure the document types for the transactions you are currently using just once through the Document types, and then start using them for reconciliation.

Question: If the company has established and uses reconciliation rules, does this functionality complement Document types, or should any unresolved issues be considered?

Answer: If you want to continue using the rules, leave the Income/Expense Category and Project fields empty in the Document types. These will be pulled from the reconciliation rules settings, while the entry itself will be generated according to the Document types settings.