When creating bank accounts, if they are not in the system’s base currency, you can set the exchange rate.

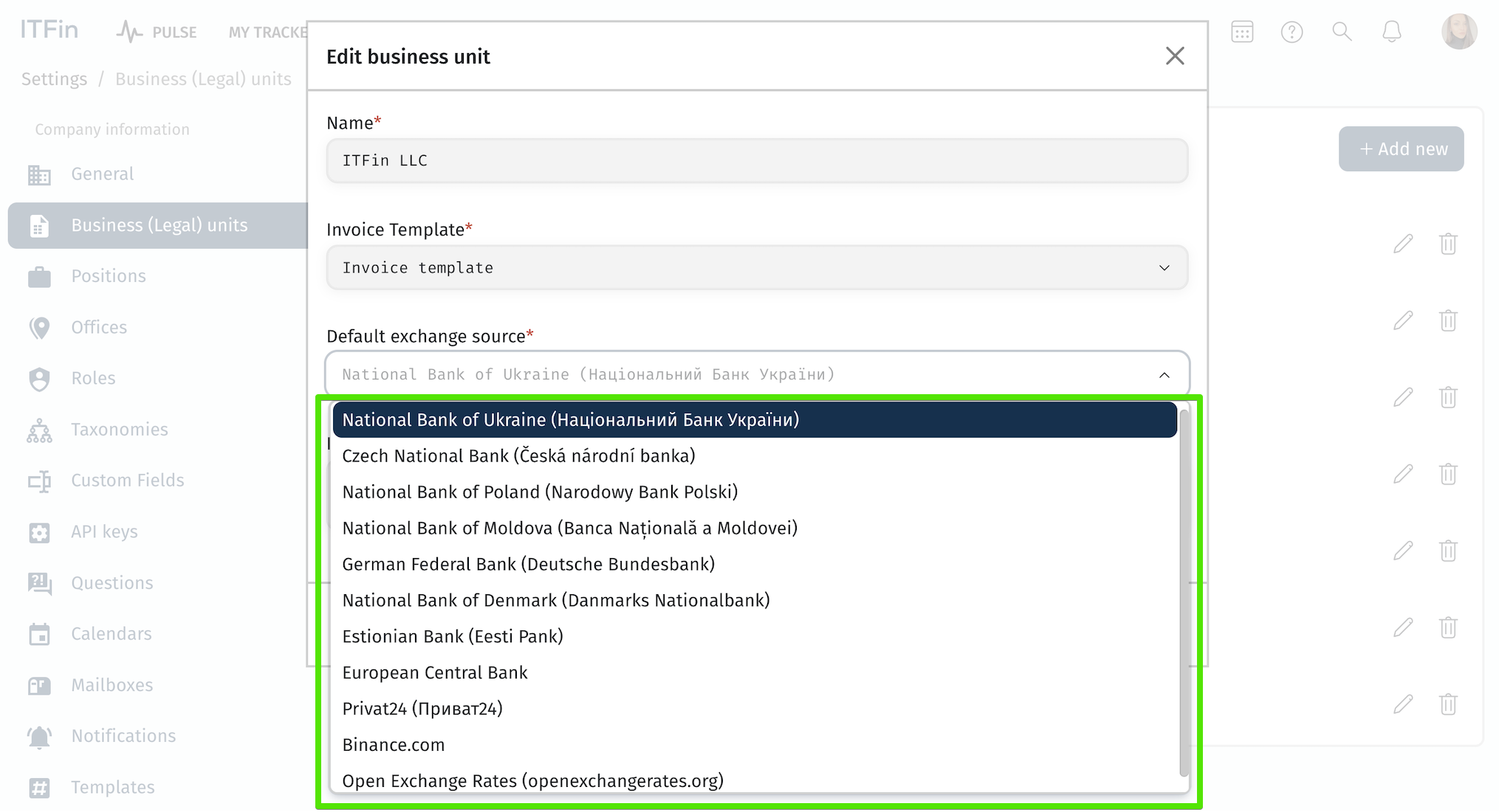

By default, the system offers the following exchange sources:

You can also specify the exchange source in business units, and it will be used in the parts of the system where the business unit is referenced, particularly during invoice calculations.

Thus, in all transactions involving accounts in a currency different from the base currency, the previously set exchange rate in the settings will be used. This will also be the basis for calculating the exchange rate differences.

The important criteria for calculating exchange rate differences in the P&L report are:

1. Accounts must be added in the P&L policy for generating entries in the Forex line item.

2. To display the Forex line item in the P&L report, such a line item must be added.

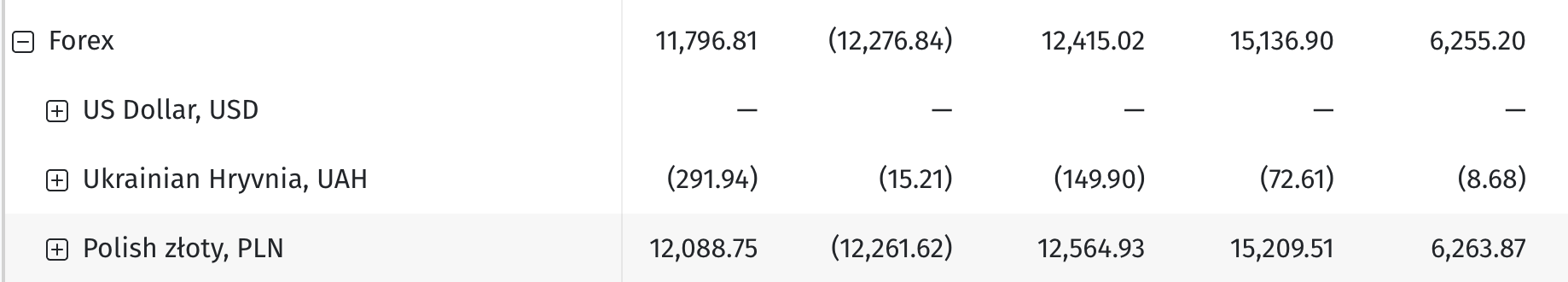

We also see exchange rate differences in the Cash Flow report, where the beginning and ending balances for the month are indicated. The system calculates the exchange rate differences for all transactions within the selected period, sums them up, and displays them in the Exchange Rate Differences (Forex) line item.

Thus, we can see exchange rate differences categorized by currencies and accounts in those currencies.

The next report in which we see exchange rate differences is the Trial Balance. There is a specific option to display the report with exchange rate differences or to hide them. If we choose to display them, the exchange rate difference will be shown for those accounts marked as monetary in the settings.

In the Chart of Accounts, when setting up each account, you can specify that it is a monetary account, and exchange rate differences will be calculated for it.