Fixed

Provided that the employee has a fixed salary, the use of vacation and sick leave as outlined by the company’s policy does not affect their earnings, and the employee receives the agreed amount for the month without changes. If the employee takes unpaid leave, the calculation is as follows:

Assuming the employee’s salary is $2000, and there were 21 working days in February. If the employee takes one unpaid day off, the system divides the total amount by the number of working days to determine the amount for one working day and subtracts it from the total amount.

2000/21 = $95.24

2000 - 95.24 = $1904.76

If an employee with a fixed salary needs to be awarded a bonus, it is added on top of the base fixed amount.

Variable

The calculation for an employee with a variable salary depends on the number of working hours in the month and the tracked hours. If the employee’s compensation is set at $2000, and there are 168 working hours in February, but the employee only worked 100 hours, they will receive payment only for the hours worked. The calculation will be as follows:

(2000/168) × 100 = $1190.48

When an employee with a variable salary takes paid leave or sick leave, the calculation also depends on the number of working hours in the month and the reported hours. For example, if the employee took 3 days of leave in February, totaling 24 hours, and worked 144 hours, the total equals 168 hours — the monthly working hour norm for February.

The calculation for vacation compensation is as follows:

(2000/168) × 24 = $285.71

So, the compensation for 3 days of leave is approximately $285.71.

The total amount in the payroll would be shown as follows:

(2000/168) × 144 = $1714.29 (For hours worked)

(2000/168) × 24 = $285.71 (Vacation)

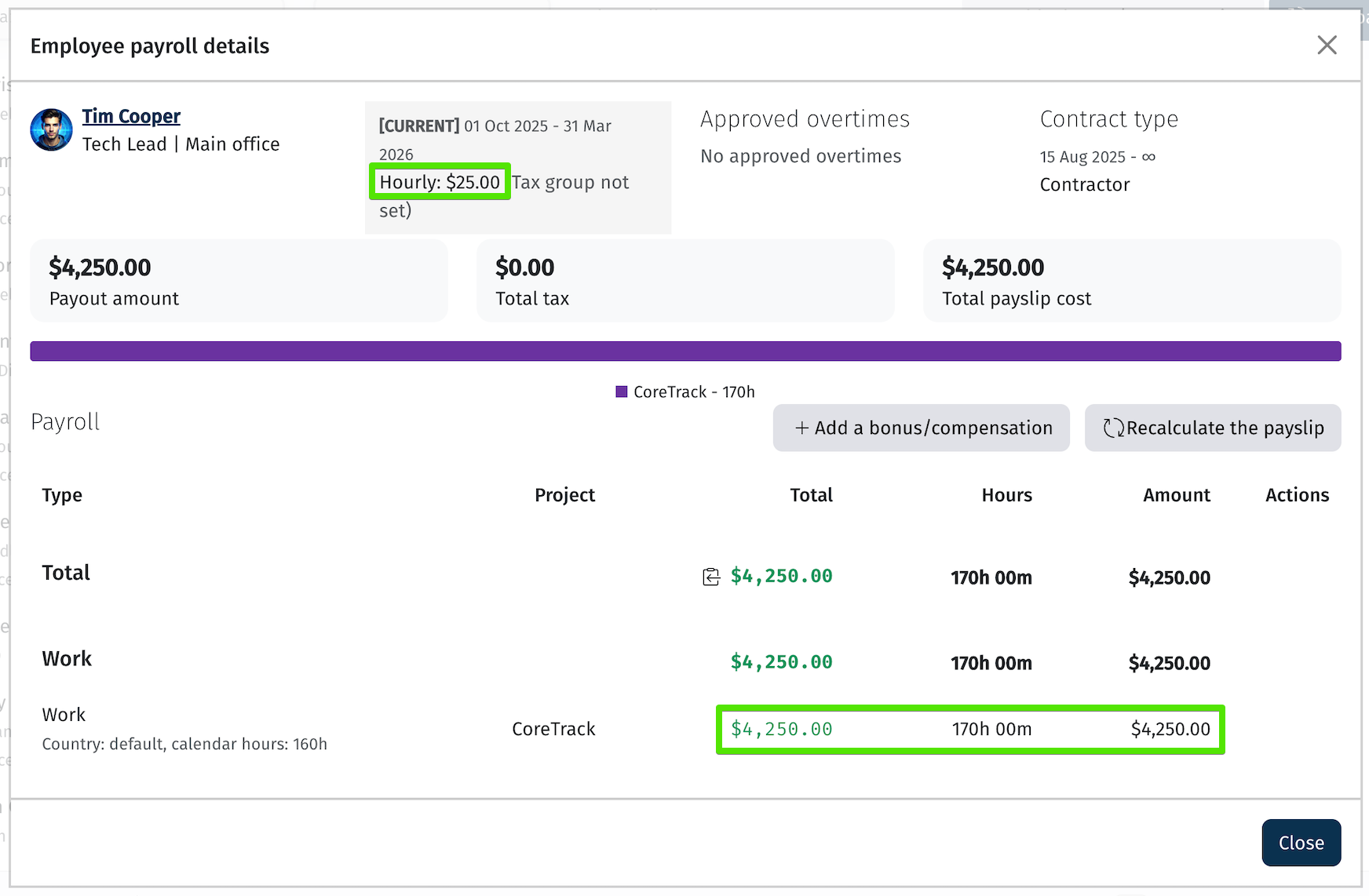

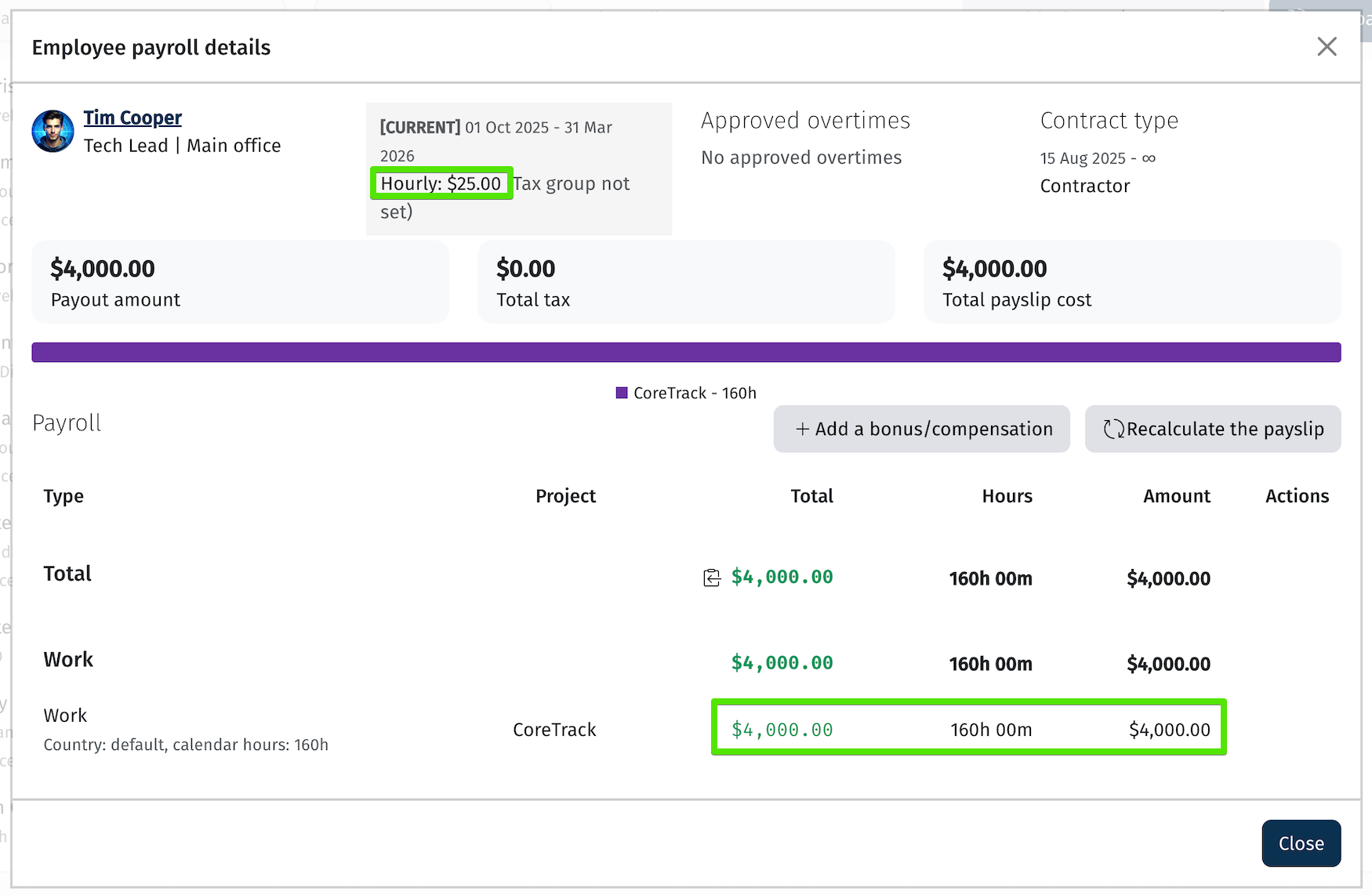

Hourly

With the hourly payment type, an employee is assigned a rate per working hour. Salary is calculated based on the actual time recorded.

The system multiplies the number of reported hours within the selected period by the hourly rate. There is no limitation based on the monthly calendar norm — all recorded hours are included in payroll and paid.

Example:

If the hourly rate is $25 and the employee reported 160 hours:

160 × 25 = $4,000

If the employee reported 170 hours:

170 × 25 = $4,250

All recorded hours are taken into account when generating the payroll statement.