Interface overview

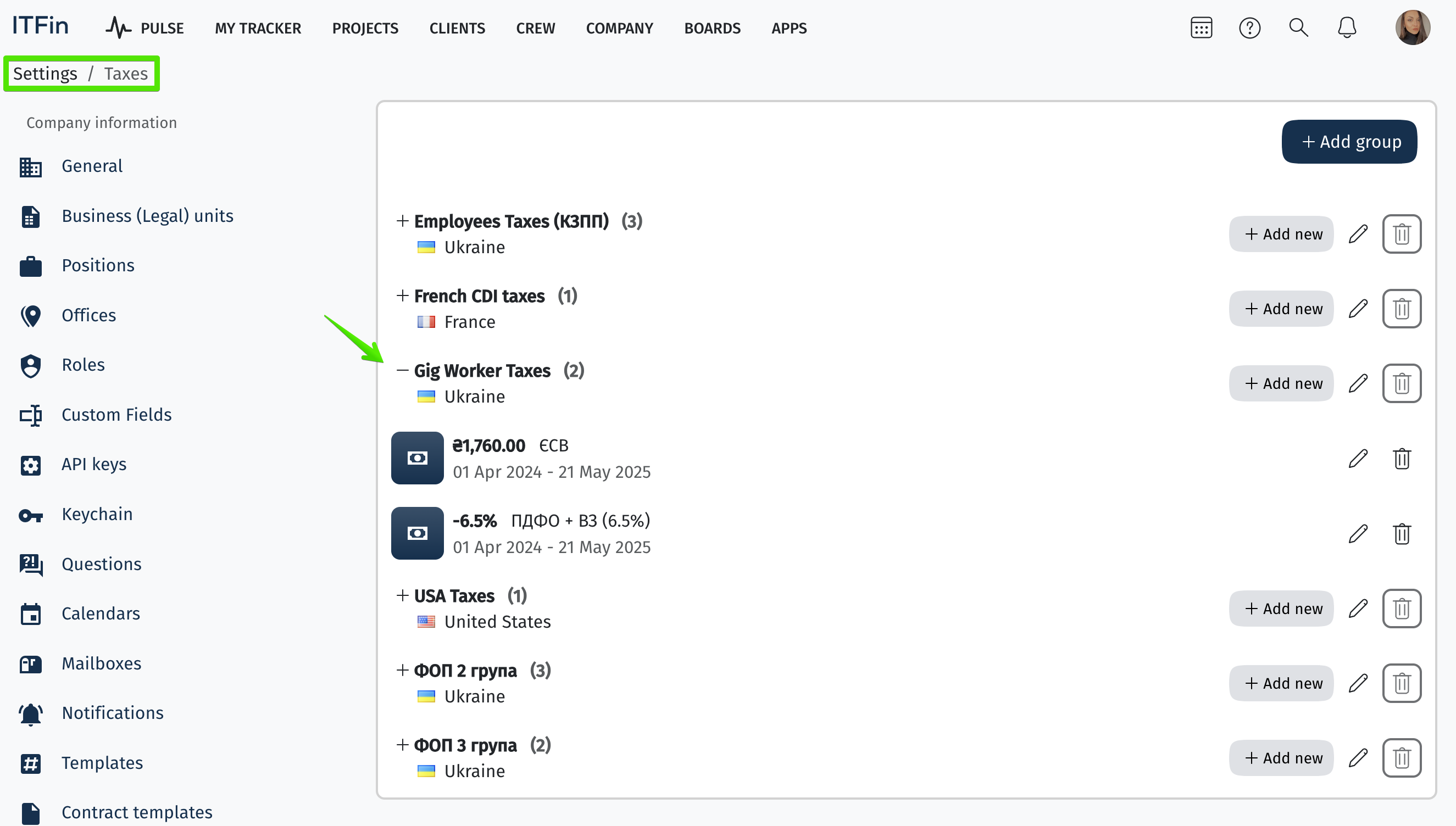

In the ITFin system, you can create tax groups that will be applied to employee salaries based on the accounting type. These tax settings are configured through the Settings > Taxes section.

You need to create separate groups, for example, for PE, gig workers, and employees, and add taxes to them, which can be specified either as a fixed amount or as a percentage. Each tax will have its own rules and financial entries, so it is necessary to add separate accounts by going to the Company > Settings > Chart of Accounts section.

Currently, access to these settings is regulated by the scopes