Depreciation is reflected in the Depreciation & Amortization line of the P&L report and begins to accumulate from the following month after the inventory is put into operation.

In the ITFin system, depreciation is calculated using the straight-line method, with the calculation performed using the formula: (original cost - liquidation value) / depreciation term.

Depreciation is carried out according to the selected inventory category. Inventory categories can be set in the Company > Settings > Inventory Categories section. Access to this section is enabled through the scope

In the category window, there are fields for the Amortization time, where the depreciation period in months is specified, and the Liquidation amount. If the category is designated for low-value assets (such as a computer mouse, headphones, etc.), the Amortization time should be set to 0. Such assets will be immediately expensed. Otherwise, depreciation will be calculated starting from the beginning of the month following the date of putting the asset into operation (if you specify 1, the expense will occur in the next month).

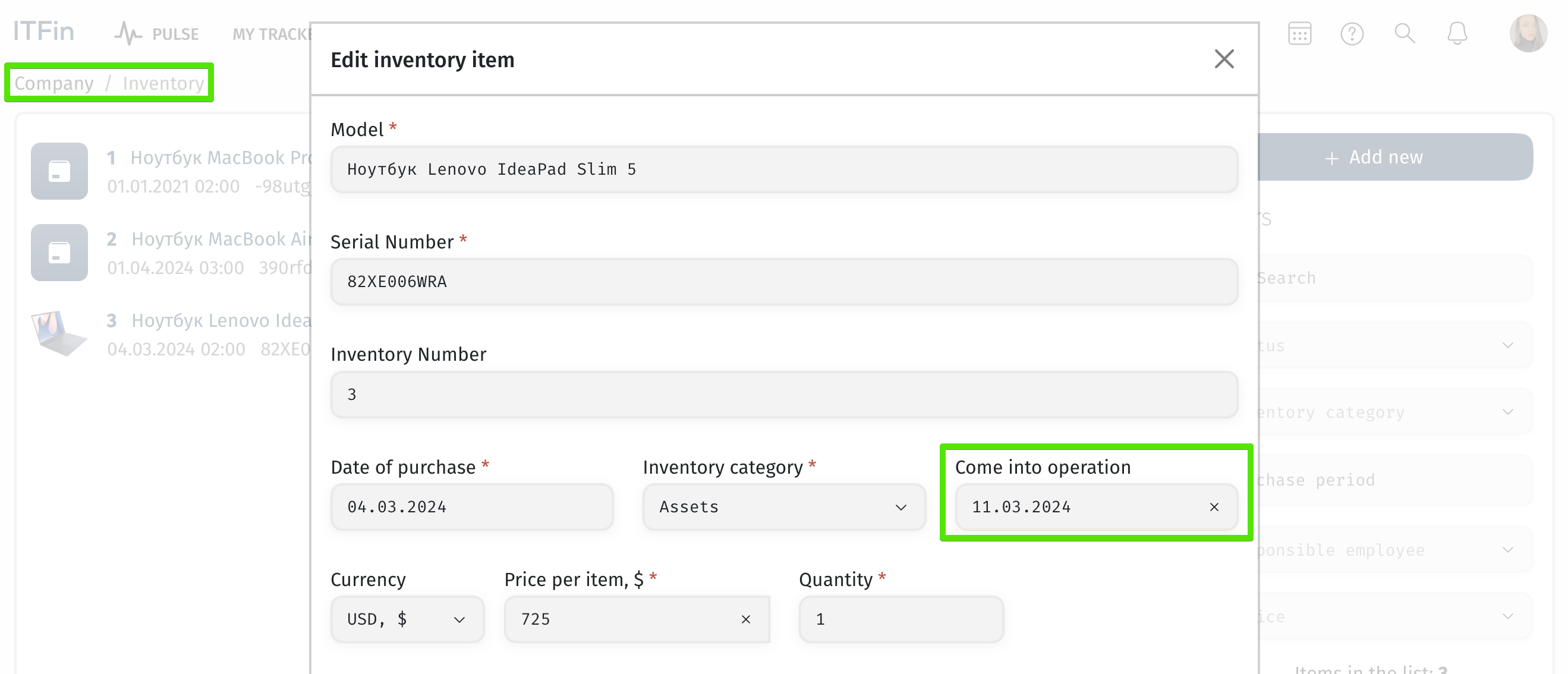

The field Comes into operation for the date of putting into operation appears if the selected category has a specified amortization period.