The cash flow report can only be viewed after transactions have been reconciled in the system.

The report is not based on journal entries, meaning the Chart of Accounts and double entries do not matter. The key element is the Income/expense category field selected in the transaction.

Additionally, the selected category in the Income/expense category field must be linked to the corresponding entry in the Cash Flow lines reference.

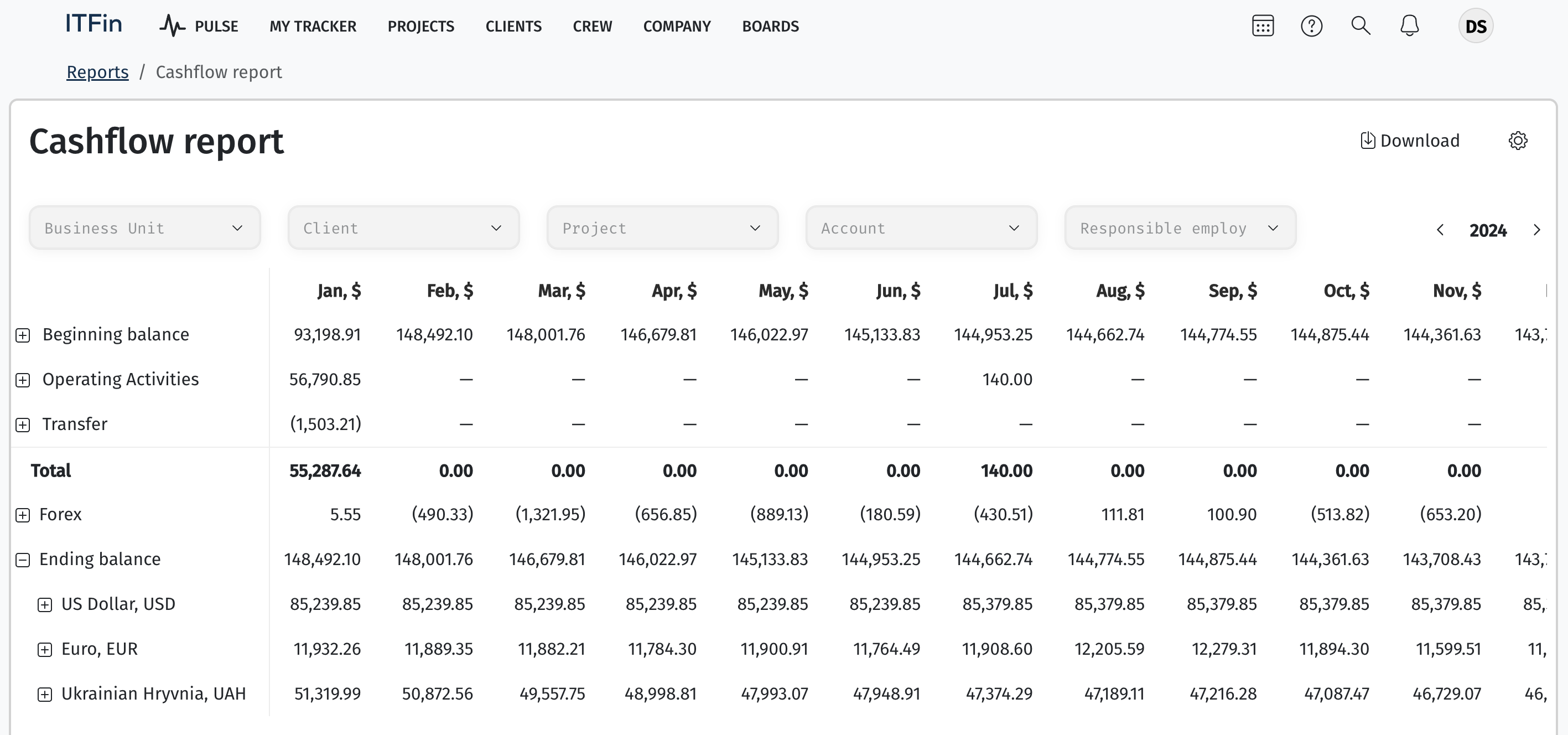

Example of a report:

By clicking on the amount for each category, you can see which transactions are included and further verify if the data was entered correctly.

The report displays data in the company’s base currency, and an exchange rate loaded by the system is used to convert amounts to a single currency.

Currency exchange losses are shown in the Forex row.

Why might the data in the cash flow report be incorrect?

Incorrect data means that the amount of money at the beginning of the period, plus or minus the money during the period, does not equal the amount at the end of the period:

1. The Income/expense category field is not filled in the transaction. This cannot happen when creating a transaction manually, as the field is mandatory. However, it can occur when using document types during reconciliation if an operation type is selected where the Income/expense category field is marked as hidden or optional, and nothing is filled in the “Income/expense category (optional)” row.

2. There is no link between the entry in the Income/expense category reference and the entry in the Cash Flow lines reference. This means that at the primary level (in the transaction), the information exists, but it is unclear where it should be displayed in the report.