This functionality is implemented to record payments for certain expenses to vendors. Purchase invoices serve as documents that generate accounts payable. The debit side of the entry is formed based on the category selected when creating the invoice.

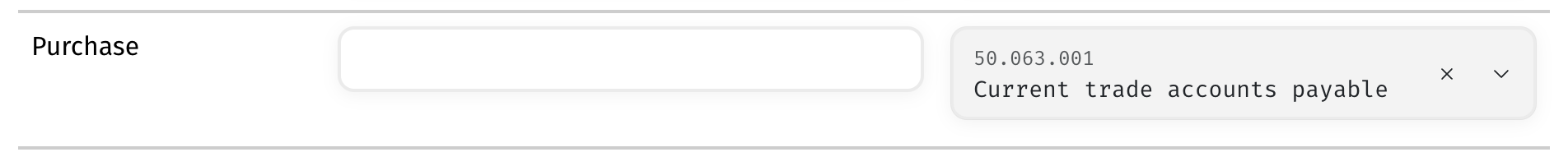

The credit side is recorded in the P&L policy under the Purchase position.

Expense categories can be edited in Company > Settings > Expense Categories.

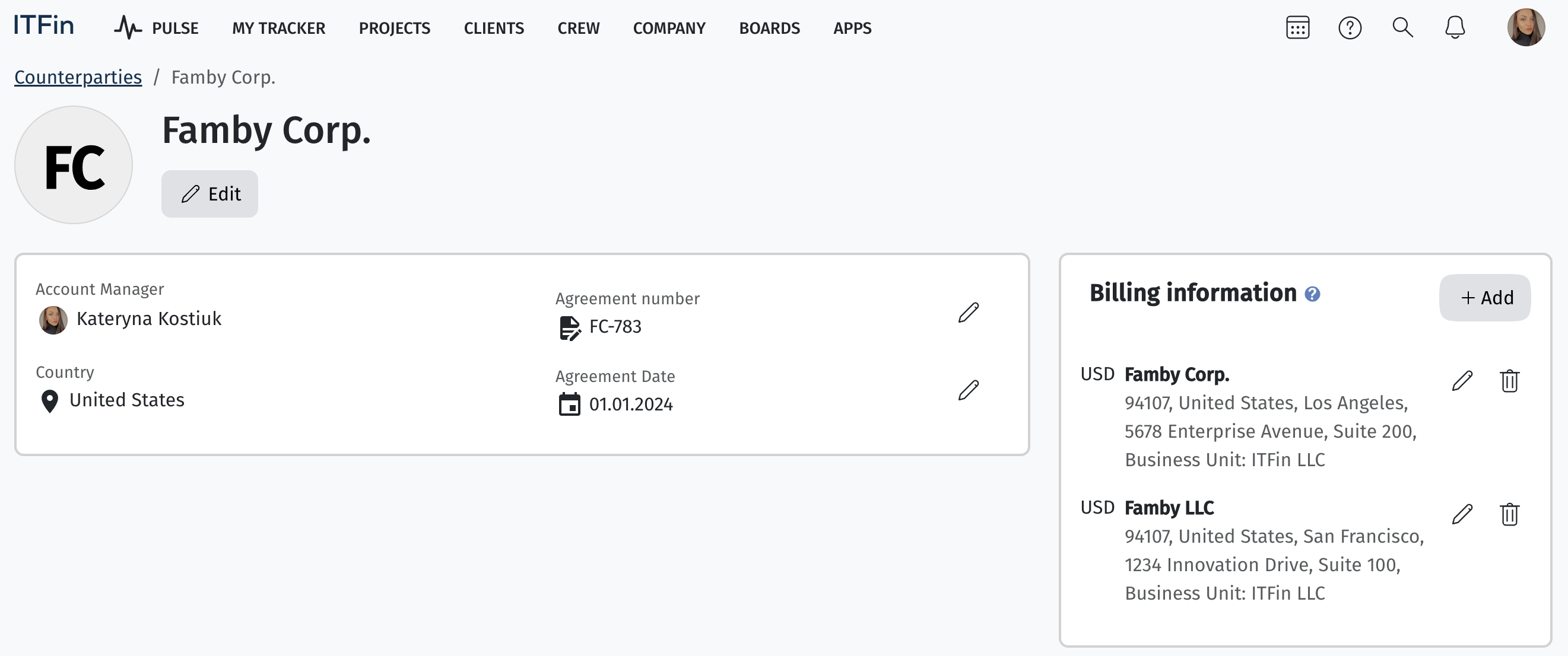

To start working with purchase orders, you must add vendors you collaborate with in Clients > Counterparties.

Using the functionality is quite simple. First, you should add the necessary vendors to whom payments will be made. Then, go directly to the Purchase Invoices section and select the option +Add new.

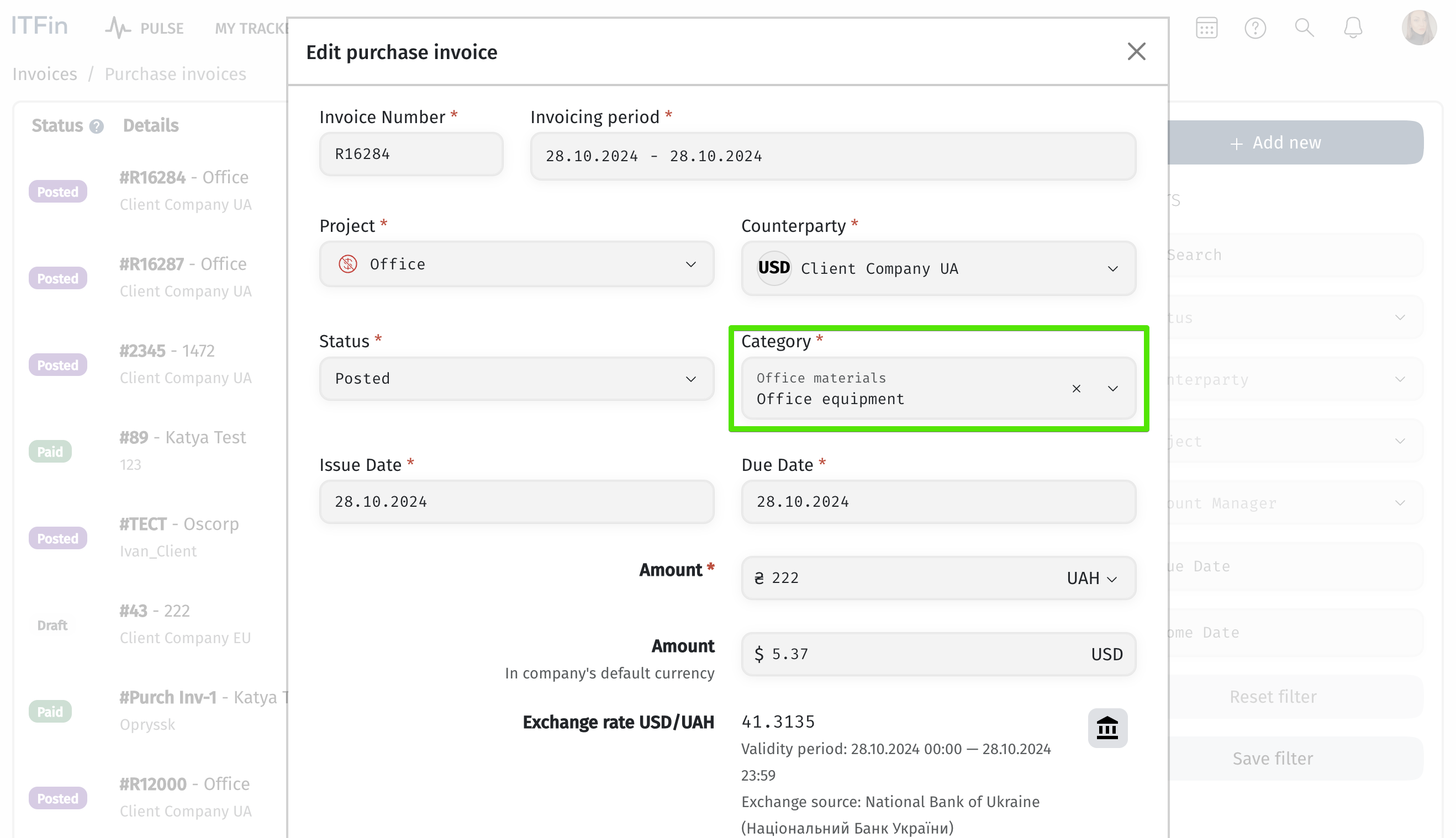

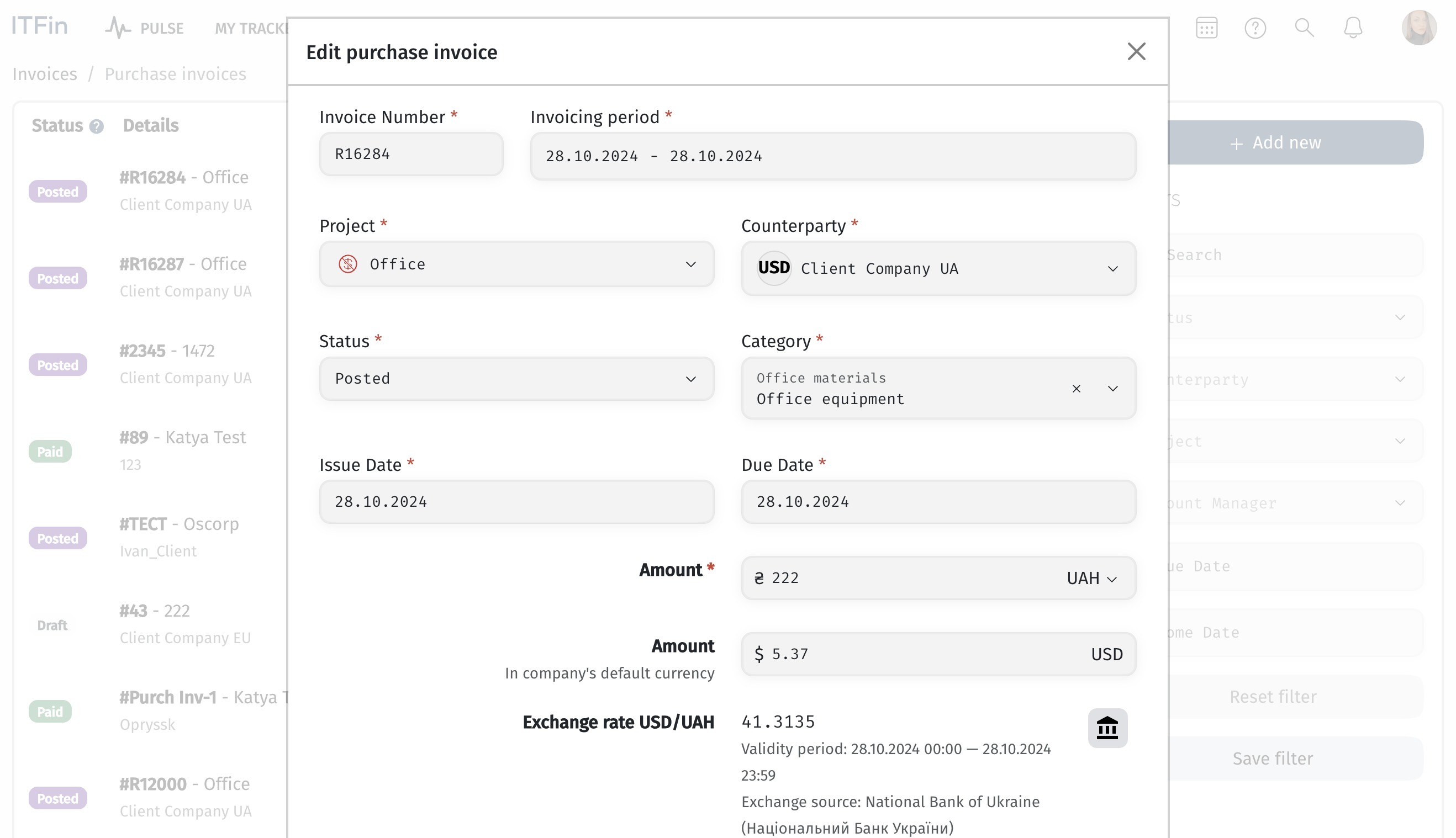

To add an invoice, the following modal window will open for you to fill out:

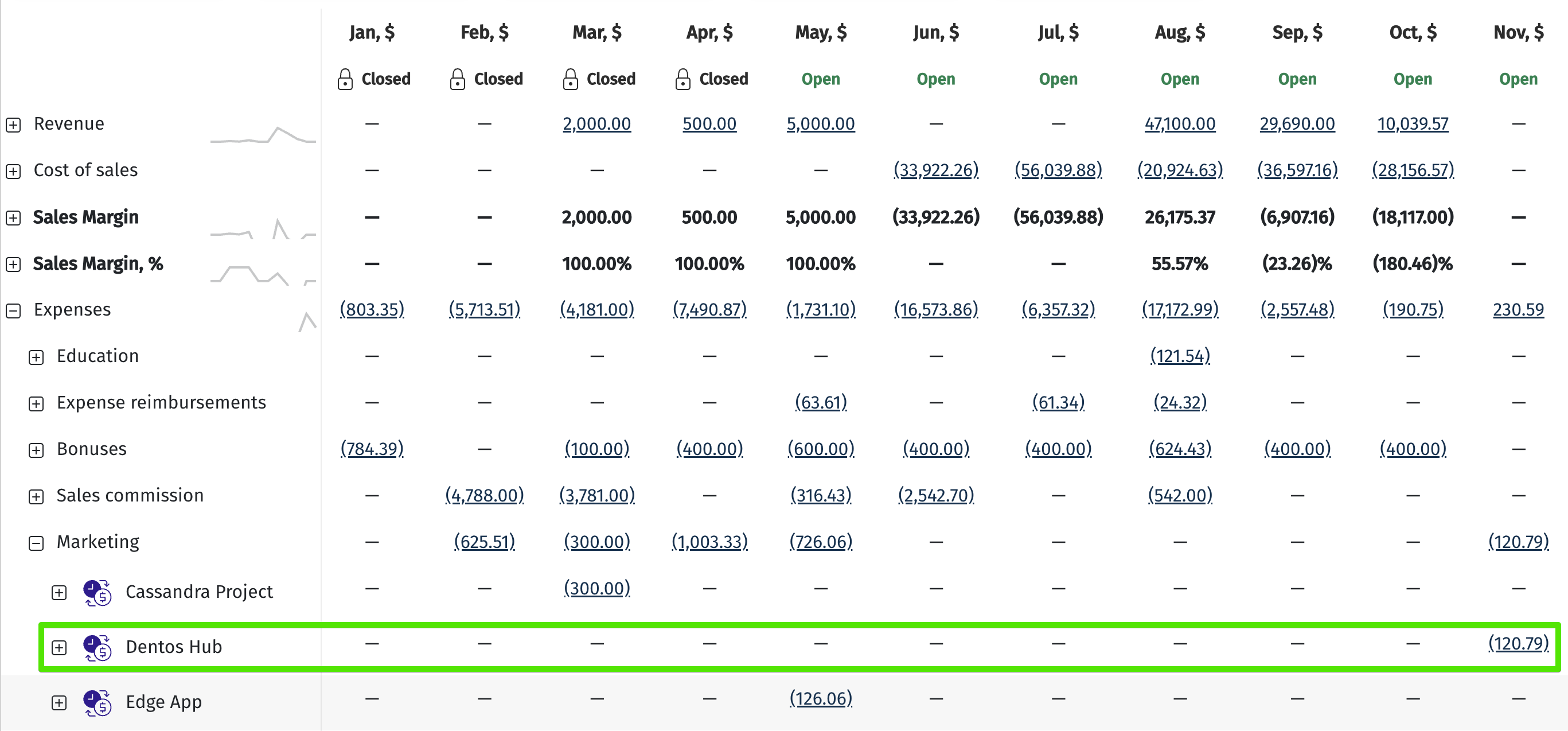

An invoice can be created as a draft if it requires review or potential correction. Once it's approved, it can be moved to the Posted status, after which, according to P&L settings, it will appear in the report.

This example shows that the previously generated invoice has been added to the report.

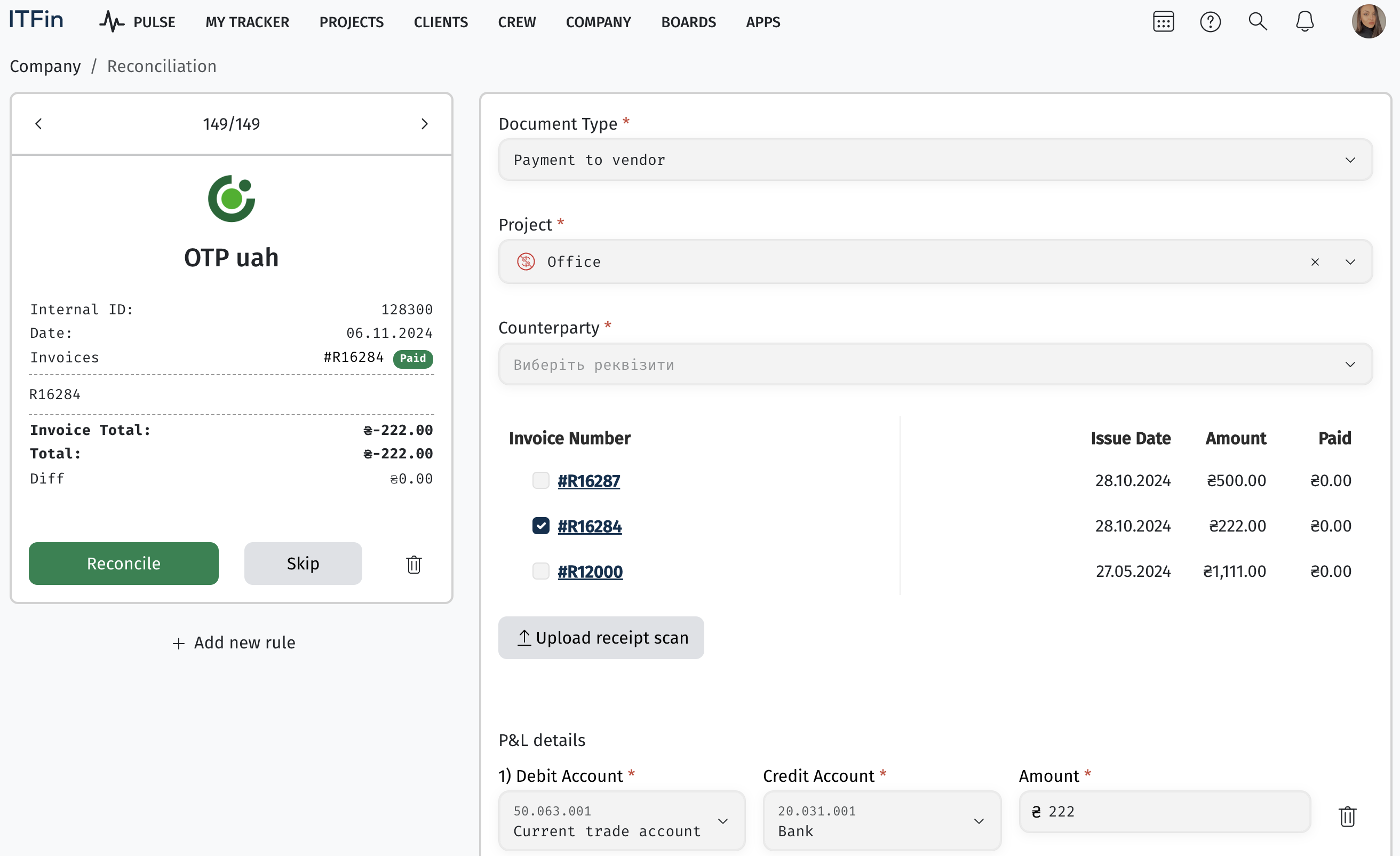

The next step is to process the payment in the system. This can be done either by uploading a bank statement or by manually adding and reconciling a transaction. During reconciliation, select the document type specifically for vendor payments and the relevant project; the system will automatically pull in all invoices that are in the Posted status and match the currency of the transaction being reconciled.

When we select the required invoice and the payment amount fully matches the amount indicated on the invoice, the system will automatically set the invoice's status to Paid. If the payment is partial, the status will be marked as Partially Paid until the invoice is fully paid.