How to allocate expenses if an employee is involved in two projects?

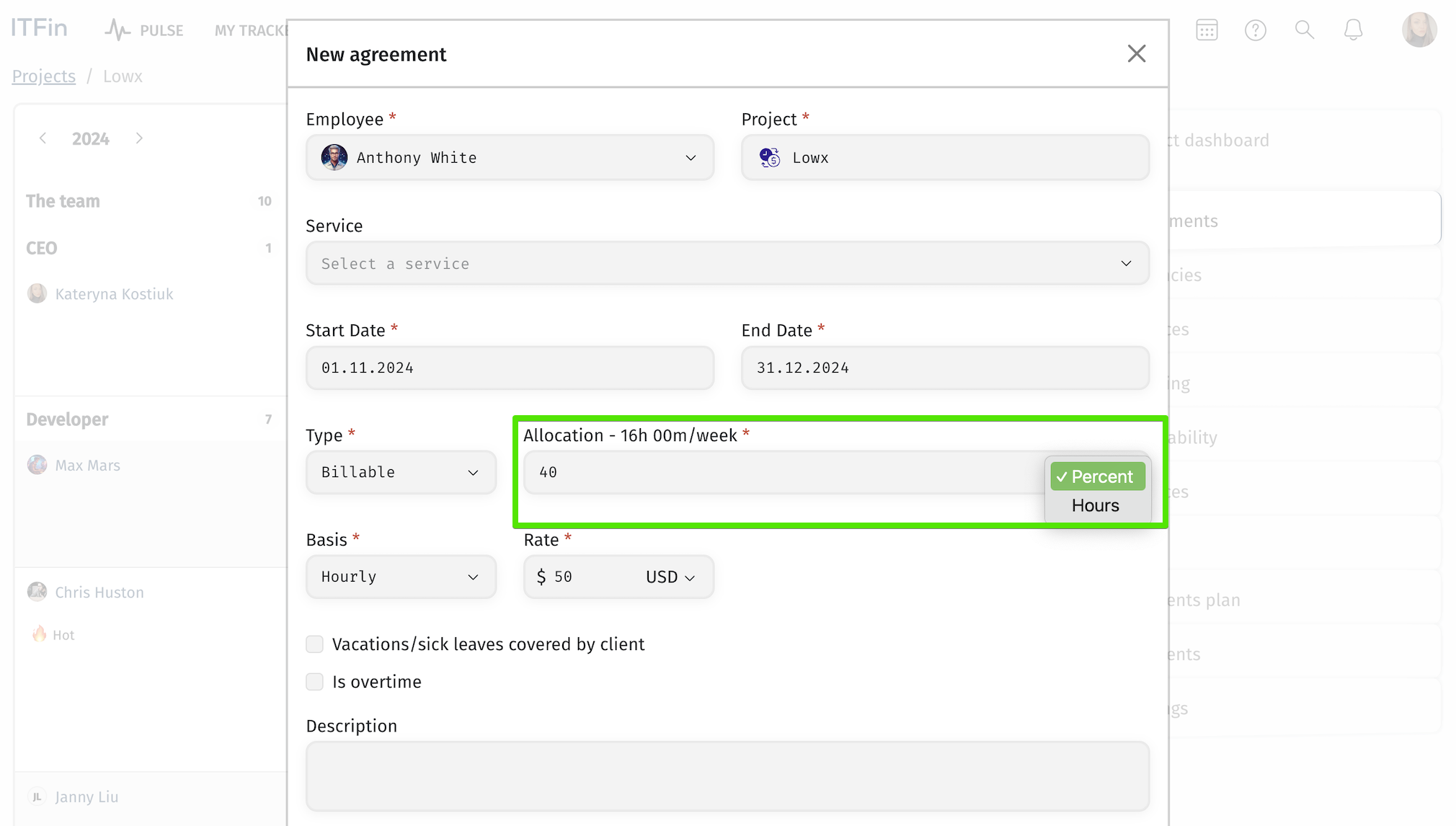

You need to specify the employee’s agreements for both projects and set the allocation in percentage or hourly ratio according to the planned distribution of working hours for the projects.

How does the system account for planned vacation expenses?

The system calculates planned vacation expenses evenly throughout the year. For example, if an employee has 18 days of paid vacation per year, which is 1.5 days per month, the planned expenses for 1.5 vacation days will be accounted for each month. If the employee is involved in multiple projects, the expenses will be distributed according to the specified allocation in the agreement. Actual vacation expenses will be accounted for once the vacation reported by the employee has been approved.

How to adjust the agreement if there have been changes (change in the rate or distribution)?

For such changes, there is an option to Split the agreement. It is important to ensure that the Start Date of the new agreement is not later than the End Date of the previous agreement. This is a precautionary measure in the system to prevent a gap between these agreements. The system will automatically adjust the End Date of the previous agreement to the day before the Start Date of the new one.

What is the difference between Monthly and Flat rates?

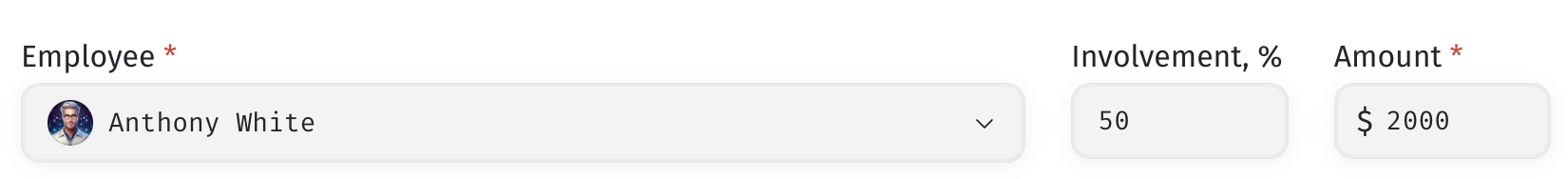

Flat rate means a fixed monthly rate that does not depend on the number of hours worked. However, on a Monthly basis, it is assumed that the employee will be fully involved in the project (dedicated team). A monthly rate is set, which is fully paid only if the planned number of hours is worked according to the number of working days in the month. For example, if the agreement is to pay $4000 per month for 160 hours, but the employee reports only half — 80 hours, then when generating the invoice, the involvement percentage is calculated. For 50% of the hours worked, the amount to be paid will be $2000 instead of $4000.

How to split agreements correctly?

To change the rate or the base of an agreement, use the Split option. It allows you to apply new conditions starting from a selected date, while the previous terms remain stored as historical data.

After clicking Split, a modal window opens with the previous agreement details. Here you need to set:

-

Start date

-

End date